The Four Archetypes in the NFT market

Almost 75 years ago Carl Jung tried to make sense of human behaviour. He defined 12 core universal motivations that consistently drive human behaviour across the globe, defining these as archetypes. The word archetype itself derives from the ancient Greek meaning original pattern. While this article is not specifically about human psychology, markets rely on it, and the NFT market is no different.

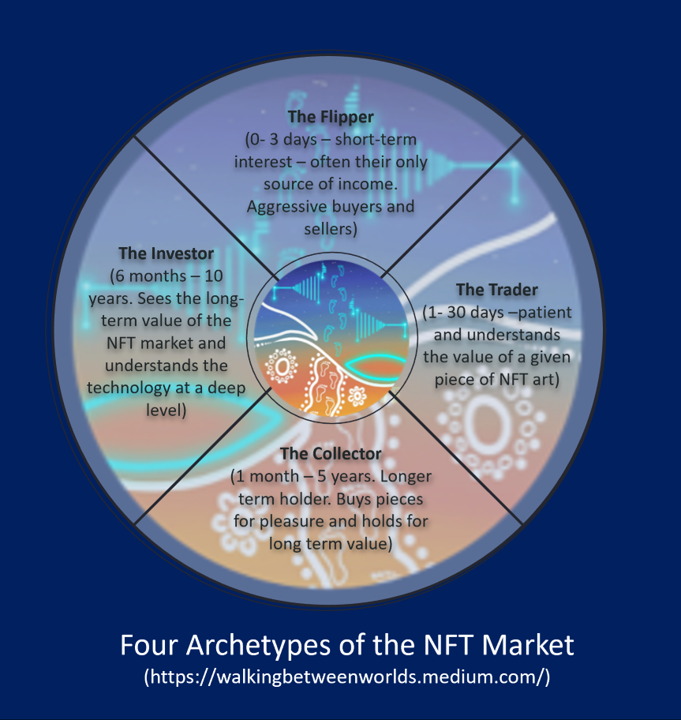

The NFT market has very similar structures to the cryptocurrency markets, which should not be too surprising as NFTs evolved directly from the technology underpinning cryptocurrencies. In later articles you will see how the cryptocurrency markets directly and indirectly influence the NFT market, but suffice to say at its very core, the NFT market comprises four archetypes . These archetypes all interact with each other to create and establish a market — whether it be a Profile Picture (PFP) Collection or for an individual NFT artist.

Any marketplace comprises buyers and sellers and behind every buy or every sell decision there is an individual. Each has their own motivations to buy and sell at that particular time. For both artists and NFT investors, it is essential to understand the core motivations of these four archetypes in order to optimise your NFT sales or investment strategy.

I want to define these four layers as the four market archetypes:

Before we go on, it is important to understand that many NFT buyers will have differing elements of the four archetypes shown above. These may vary according to the individual’s financial motivations at any given time. That said, through the transparency of the public blockchain underpinning NFT marketplaces, anyone can analyse the data of (most) individuals to make a broad assessment of their motivations . Let’s consider the different archetype’s behaviour and action.

a. The Flipper

Timeframe: 0–3 days

The flipper is a short-term trader — almost like a day trader in traditional markets. They want short-term gains usually in the very short-term — the 0–3 day timeframe. So often this is the way the flipper makes their day-to-day income.

The Flipper’s usual modus operandi will be to buy the artwork at the “mint” or “drop” stage — i.e. when an art piece is first released to the market. They will then flip the piece for a short-term profit. They take advantage of the fact that NFTs are limited in supply, and that for a popular artist, or very popular PFP projects, there will be a mismatch between demand and supply, creating favourable conditions to sell at a profit. Their process is usually preparation and research — based around community interaction and growth.

1) They will target a successful artist with a strong following — especially those with celebrity support — or a PFP project that has a lot of hype. They will assess the hype by checking the size of their (genuine) twitter following or the size of the (genuine) number of people in their discord channel and the level of (genuine) engagement.

2) They wait for the artists or PFP project to announce via their discord channel new pieces will be dropped (if you see it on twitter you are already too late…)

3) They will get in on whitelists to pre-buy the artwork with lower gas fees

4) They then wait… patiently creeping up, stealthily making careful preparations to ensure everything is optimised, lying in wait until the mint’s countdown begins its slow downward trajectory. The heartbeat increases; the adrenalin begins to flow, the beads of sweat form of a furrowed brow, the pulse rises to a crescendo as the countdown hits…

They pounce. The mint is dropped. They optimise their gas. They frenetically buy. They curse at their laptop screen as the Ethereum blockchain takes its 15 seconds to confirm the transaction — the pulse racing in expectation another flipper might win the piece if their gas fee is higher. Have I got it , yes, no ...yes … no ? They fist pump the air as they allow a well-deserved yes!!! releases the tension . Immediately they put it up for re-sale. They rinse and repeat.

Typically, a flipper will try to sell for a 2x profit to cover their costs plus the gas fees, with a flipper often buying multiple pieces aiming to sell half for 2x return thereby covering the majority of all their costs giving them essentially free pieces to hold and enabling them to re-invest into the next mint.

b. The Trader

Timeframe: 1–30 days

The trader is more patient. They know an artist’s work or a PFP project intimately. They know the current market prices paid for any piece in a collection. They will undertake deeper, more focused research.

For PFP projects, typically 10,000 units are produced. The trader will know in a heartbeat what makes a rare piece in a 10,000 collection — often using tools such as Rarity Tools. Rarity tools not only identifies how rare a given piece is in relation to its peer group, but also gives an indication of the expected price. The trader snipes in a similar way to the flipper, above. They will see the items up for sale and will quickly assess from their experience is the piece above or below market rate instinctively assessing the profit opportunity. They will buy the piece in the expectation of a healthy profit in a few days.

The trader relies on the fact that in any market, different people are selling for different reasons. In weak market conditions, people want to sell to get their funds back, or perhaps to perhaps re-invest in Bitcoin or Ethereum which might be showing strength. Traders recognise that they can buy a quality piece for a discount and will often put out many low-ball offers for those looking to sell — working on the basis that the law of large numbers means they are likely to get some pieces below market rate. As the market conditions improve so they re-sell for a profit.

c. The Collector

Timeframe — Longer- term hold — 1 month — 5 years

The collector is someone who tends to be a longer-term holder. Perhaps they initially resonated with the art, the artist or the project they bought into. They tend to hold on to pieces and ride the volatility of the individual markets — not wanting to stare at a computer screen every day to monitor their position . Collectors tend to be focused on ownership and the pleasure they derive from the pieces themselves and will hold for the longer-term where they expect to see the growth in value. They like to get to know the artists and to understand more about an artist and their creative drivers . They will also want to get the benefits of being a longer-term collector — e.g., getting private access to new mints — often through the artist’s private discord channels — so they do not face having to get up at 5am in the 24-hour NFT market to buy a piece or face heavy gas fees.

d. The Investor

Timeframe — 6 months — 10 years

There are projects that have grown exponentially in the past 12 months creating the exponential returns that can only make professional investors salivate. For example, Cryptopunks which have deep cultural significance for the cryptocurrency community but were given away for free back in 2017.

In the market, investors now view these pieces as blue-chip pieces — selling for multiple millions of dollars. The majority of heavyweight investors totally understand the power of the underlying blockchain-based technology to provide them with the comfort that the pieces are unique and that can simultaneously authenticate the investor’s ownership.

Investors typically hold for the longer-term, recognising that as the NFT marketplace increasingly explodes towards the mainstream, so the values will rise significantly. This is especially true for Institutional funds that cannot invest in unregulated structures. In the medium term, NFT markets are likely to follow the crypto markets, where regulated funds will be created dedicated to NFTs and to holding blue chip NFTs that have demonstrated investment growth. Because these pieces are limited in supply — and the demand is likely to increase significantly — so will the longer-term prices.

The investor is making a pure investment decision — how will the piece rise in value for the longer-term.

From the above analysis you can see how the market typically operates with four archetypes — each with different timescales, profiles and motivations. Carl Jung understood archetypes as the driver of human motivation. It is vitally important for you as an artist or investor to understand what motivates your buyers, sellers or competitors.

In the next article we will examine how to identify a buyer’s or seller’s motivation from the transparent data available for NFT marketplace.

About the author

Tim Lea (@timothylea2 on twitter) is author of the book Down the RabbitHole, a book on the blockchain in plain English, an international keynote speaker on the strategic application of the blockchain, and an investor in NTFs and the cryptocurrency space. He is the co-founder of a new Social Impact project Walking Between Worlds (@WBWNFTS on twitter) whose mission is to energise global Indigenous communities to amplify First Nations powerful voices through NFTs